Stories related to End of Day Nifty Midcap 150 Report |

|---|

Nuvama initiates coverage on these 3 defence stocks, sees up to 22% upside

Nuvama highlights that most private defence companies are currently trading at a premium compared to Defence Public Sector Undertakings (DPSUs), driven by stronger earnings growth and better return ratios.Maintaining a bullish view on the Indian defence sector, domestic brokerage firm Nuvama has initiated coverage on Hindustan Aeronautics (HAL), Bharat Dynamics Ltd (BDL) and Data Patterns, foreseeing [+4086 chars] [Bharat Dynamics Ltd] 4/21/25, 8:17 AM[Nishtha Awasthi][The Times of India] |

Buy or sell: Vaishali Parekh recommends three stocks to buy today 11 April 2025

Buy or sell: Vaishali Parekh recommends three stocks to buy today Oil India Ltd, Kalyan Jewellers India, and NHPC[Oil India Ltd] 4/11/25, 7:04 AM[Mint] |

Hold SRF, target price Rs 2,715: ICICI Securities

ICICI Securities maintains a hold call on SRF, setting a target price of Rs 2715. SRF's Q3FY25 consolidated total income rose 14.95% YoY to Rs 3530.95 crore, with a net profit of Rs 271.08 crore. Anticipated growth in specialty chemicals and ref-gas is expectICICI Securities has a hold call on SRF with a target price of Rs 2715. The current market price of SRF Ltd. is Rs 2835.4. SRF, incorporated in 1970, is a Large Cap company with a market cap of Rs 81 [+1736 chars] [SRF Ltd] 4/15/25, 3:21 AM[ETMarkets.com][The Times of India] |

Neutral on KEI Industries, target price Rs 3,000: Motilal Oswal Financial Services

Motilal Oswal Financial Services maintains a neutral stance on KEI Industries. The target price is set at Rs 3,000. KEI Industries faces potential competition from UltraTech Cement and Adani Group. Despite this, business fundamentals remain strong. The brokerMotilal Oswal Financial Services has a neutral call on KEI Industries with a target price of Rs 3,000. The current market price of KEI Industries Ltd. is Rs 2603.3 . KEI Industries Ltd., incorporated [+2433 chars] [KEI Industries Ltd] 4/15/25, 3:41 AM[ETMarkets.com][The Times of India] |

Delhivery, Ecom Express seek CCI nod for their Rs 1,400-crore deal

Delhivery Ltd and Ecom Express have sought the Competition Commission of India's (CCI) approval for their Rs 1,400-crore deal. Delhivery will acquire a controlling stake in Ecom Express for a cash consideration. The proposed transaction reflects the Indian ecNew Delhi, Logistic firm Delhivery Ltd and Ecom Express have sought Competition Commission of India's approval for their Rs 1,400-crore deal. Under the deal announced on April 5, Delhivery will acqui [+1677 chars] [Delhivery Ltd] 4/19/25, 11:44 AM[PTI][The Times of India] |

Best way to prepay your home loan: Save Rs 7 lakh and pay off 36 months early with this prepayment strategy

With recent repo rate cuts by the RBI, home loan borrowers now have opportunities to accelerate their repayment. Strategies like utilising surplus funds for occasional prepayments, making fixed annual prepayments, or incrementally increasing EMIs can significGood days for home loan borrowers are finally here, as the interest rate reduction cycle started early this year with the Reserve Bank of India (RBI) reducing the repo rate by 0.25% in February, whic [+4592 chars] [Bank of India] 5/1/25, 12:42 PM[Naveen Kumar][The Times of India] |

India-US yield spread sees historic shift. How it may impact rupee and interest rates

A rare financial event occurred on April 11th as the U.S. and India 10-year government bond yield spread dipped below 2% for the first time. This compression, driven by factors like U.S. fiscal deficits and tariff war fears, grants the Reserve Bank of India gOn April 11th, a significant yet largely overlooked event unfolded in our financial markets. Amidst the usual noise driven by tariff headlines, investors failed to notice a rare phenomenon taking pla [+4658 chars] [Bank of India] 5/1/25, 3:06 AM[ArunaGiri N][The Times of India] |

Bank holiday today: Are banks open or closed on May 1 for Labour Day, Maharashtra Day? Check here

Bank holiday today: On May 1, 2025, banks will be closed in multiple regions for Labour Day and Maharashtra Din. Online banking services will still be operational.Bank holiday today: Banks in some parts of the country will be closed on account of Labour Day and Maharashtra Din on Thursday, May 1, 2025, as per the Reserve Bank of India (RBI) guidelines.Bank h [+2147 chars] [Bank of India] 5/1/25, 1:12 AM[Riya R Alex][Livemint] |

How to contact Union Bank Visa Gold credit card customer care: 4 easy ways explained

Check out the step-by-step process to report issues with your Union Bank of India Visa Gold Credit Card using toll-free helplines, dedicated email support, the online grievance portal, or by escalating matters to senior officials.If you are a Union Bank's Visa Gold credit card user, then the bank provides an elaborate and well-structured grievance redressal process.This process has been developed to help and support Union B [+3937 chars] [Bank of India] 4/30/25, 8:20 AM[Shivam Shukla][Livemint] |

ETMarkets Smart Talk: Golds rally to persist short-term, but maintain only 3-5% allocation, says Manish Jain

The last couple of months have been quite interesting, if I may use that term. On one hand we have the economy on the recovery path, we have witnessed a couple of rate cuts from the Reserve Bank of India (RBI) and personal income tax rate cuts, on the other hIn this edition of ETMarkets Smart Talk, we caught up with Manish Jain, Head of Fund Management (PMS & Equity Advisory) at Centrum Ltd, to decode the ongoing market volatility and the outlook for [+5863 chars] [Bank of India] 4/30/25, 3:30 AM[Kshitij Anand][The Times of India] |

RBI approves executive committee to oversee IndusInd Bank operations following CEO Sumant Kathpalia's exit

The Reserve Bank of India has approved an interim executive committee to manage IndusInd Bank in the absence of its CEO. Senior executives Soumitra Sen and Anil Rao will oversee day-to-day operations under the guidance of a board-led committee, according to tThe Reserve Bank of India has approved the formation of an interim Committee of Executives to oversee the operations of IndusInd Bank in the absence of a Managing Director and Chief Executive Officer [+2699 chars] [Bank of India] 4/30/25, 2:58 AM[ET Online][The Times of India] |

Have soiled, torn or damaged currency notes? Check RBI guidelines for exchange

The Reserve Bank of India has established guidelines for exchanging damaged currency notes, ensuring that individuals don't face financial losses due to soiled, mutilated, or severely damaged notes. Banks are mandated to accept these notes, with refunds depending on the extent of the damage, and severely damaged notes require RBI evaluation.[Bank of India] 4/29/25, 4:11 PM[TOI Business Desk][The Times Of India] |

RBI instructs all banks, financial companies, and other regulated entities to use PRAVAAH portal from 1st May

The Reserve Bank of India (RBI) mandates the use of the PRAVAAH portal for all regulatory applications from May 1, 2025, for banks, financial companies, and regulated entities. This directive aims to streamline the application process, enhance transparency, aThe Reserve Bank of India (RBI) has given clear instructions that from May 1, 2025, all banks, financial companies, and other regulated entities must use the PRAVAAH portal to submit any applications [+2126 chars] [Bank of India] 4/29/25, 3:15 AM[ANI][The Times of India] |

Liquidity push: RBI to buy back Rs 1.3L cr G-Secs

The Reserve Bank of India (RBI) will purchase 1.25 lakh crore of government securities in May through open market operations (OMOs) to bolster liquidity in the banking system. This initiative, conducted in four tranches, follows liquidity-easing efforts in ATaarak Mehta's Munmun Dutta's quick shoot at the iconic Dadar Flower Market [Bank of India] 4/29/25, 1:54 AM[TNN][The Times of India] |

Rs 1.25 lakh crore OMO likely to bring down yields ahead of the new 10 year auction

The Reserve Bank of India announced it will purchase Rs 1.25 lakh crore government bonds in open market operations (OMO) in four tranches spread across May, the calendar likely aimed to drive down yields before the new 10-year auction is scheduled on Friday, treasury experts said.[Bank of India] 4/28/25, 9:11 PM[The Economic Times] |

New RBI ATM transaction rules from May 1, 2025: HDFC Bank, PNB, IndusInd notify new charges

The new guidelines focus on updating free transaction limits, revising charges for exceeding those limits, and modifying the structure of interchange fees and will come into effect from May 1, 2025.The Reserve Bank of India (RBI) has issued a revised framework for ATM transaction charges across the country. The new charges will come into effect from May 1, 2025. The new guidelines focus on upda [+2913 chars] [Bank of India] 4/28/25, 8:31 AM[Sneha Kulkarni][The Times of India] |

SGB premature exit: Get 109% tax free returns on this Sovereign Gold Bond investment if applied for premature redemption on April 28, 2025

SGB premature redemption: The Reserve Bank of India (RBI) has fixed Rs 9,600 as the premature redemption price for Sovereign Gold Bond (SGB) 2020-21 Series I. This bond was issued for Rs 4589, so this means an 109% absolute return in five years for an Gold inOffer Exclusively For YouSave up to Rs. 700/-ON ET PRIME MEMBERSHIPAvail OfferOffer Exclusively For YouGet 1 Year FreeWith 1 and 2-Year ET prime membershipAvail OfferOffer Exclusively [+246 chars] [Bank of India] 4/26/25, 12:33 PM[Neelanjit Das][The Times of India] |

Home loan balance transfer: 3 smart reasons why you should switch today

Explore the benefits of a home loan balance transfer in 2025 cut down your EMIs, enjoy flexible repayment options, and experience improved service. With falling repo rates, now is the perfect time to switch lenders and maximise your savings smartly.The Reserve Bank of India (RBI) has recently reduced the repo rate twice in 2025. First it was reduced to 6.25% in the month of February and then to 6% in the month of April. This has created a fairl [+3978 chars] [Bank of India] 4/25/25, 7:56 AM[Shivam Shukla][Livemint] |

Stocks To Watch Today: Infosys, Airtel, IndusInd Bank, Bank Of India

LTIMindtree, Bajaj Housing Finance and Tata Consumer Products are among the big names set to announce their earnings for the fourth quarter on Wednesday.[Bank of India] 4/23/25, 7:00 AM[NDTV Profit Research][Bq Prime] |

For safer digital banking, banks to move to domain Bank.in by October 31, 2025, says RBI

The Reserve Bank of India (RBI) has mandated banks to migrate their net banking websites to the exclusive '.bank.in' domain by October 31, 2025. This initiative, announced on February 7, 2025, aims to combat online fraud, enhance cybersecurity, and boost publThe Reserve Bank of India (RBI) has asked banks to move their net banking websites to the exclusive internet domain .bank.in. The RBI issued a circular in this regard today and has asked banks to com [+3109 chars] [Bank of India] 4/22/25, 12:37 PM[Sneha Kulkarni][The Times of India] |

Want to open a savings account for your child? Know the RBI rules

The Reserve Bank of India (RBI) has released updated instructions for banks regarding the opening and operation of deposit accounts by minors, aimed at rationalising and harmonising existing regulations. The revised guidelines introduce greater clarity and flApr 22, 2025, 05:46:18 PM ISTThe Reserve Bank of India (RBI) has released updated instructions for banks regarding the opening and operation of deposit accounts by minors, aimed at rationalising an [+1859 chars] [Bank of India] 4/22/25, 12:15 PM[ET Online][Economictimes.com] |

SBI reintroduces Amrit Vrishti FD scheme: Check latest fixed deposit interest rates

The State Bank of India (SBI), the countrys largest public sector lender, has reintroduced its special Fixed Deposit (FD) scheme Amrit Vrishti, aimed at offering attractive returns to depositors with a specific investment horizon. This scheme is now avaiApr 22, 2025, 01:38:53 PM ISTThe State Bank of India (SBI), the countrys largest public sector lender, has reintroduced its special Fixed Deposit (FD) scheme Amrit Vrishti, aimed at offering a [+1201 chars] [Bank of India] 4/22/25, 8:08 AM[ET Online][Economictimes.com] |

RBI took initiative to bridge communication gap with fintechs: Deputy governor

The RBI has actively engaged with fintech startups to foster ongoing dialogue, helping both sides understand each others expectations better, said deputy governor T Rabi Sankar. The regulator has encouraged responsible innovation and trust, introduced strictThe Reserve Bank of India (RBI) took the initiative to reach out to fintech startups and begin a healthy and constant conversation, which has helped the regulator understand the ecosystem better, dep [+1616 chars] [Bank of India] 4/22/25, 7:55 AM[ETtech][The Times of India] |

T Rabi Sankar gets second extension

Rabi Sankar receives a second extension as Reserve Bank of India deputy governor. The Appointments Committee of the Cabinet approved the extension, effective from May 3. Sankar manages key departments, including foreign exchange and currency management. He haReserve Bank of India (RBI) deputy governor, T Rabi Sankar has been given a second one year extension effective from May 3 after an approval by the Appointments Committee of the Cabinet (ACC), the De [+999 chars] [Bank of India] 4/22/25, 7:43 AM[Joel Rebello][The Times of India] |

Bank stocks in focus as RBI eases final LCR norms, offers relief to lenders

The final regulations have set an added run-off factor of 2.5% for retail and small business deposits that are accessible through internet and mobile banking (IMB). This is a reduction from the 5% proposed in the draft guidelines.Banking stock will be in focus on Tuesday after the Reserve Bank of India (RBI) on Monday released the final guidelines on the Liquidity Coverage Ratio (LCR), offering relief to banks through more le [+3515 chars] [Bank of India] 4/22/25, 2:58 AM[ETMarkets.com][The Times of India] |

RBI announces amendments to liquidity coverage ratio framework; directs banks to up run-off rates for digital deposits

The Reserve Bank of India has finalized guidelines amending the Liquidity Coverage Ratio (LCR) framework, set to take effect on April 1, 2026. These revisions include adjusted run-off rates for specific deposit types and haircuts on government securities, aimThe Reserve Bank of India on Monday announced amendments to the Liquidity Coverage Ratio (LCR), directing banks to assign additional run-off rates of 2.5% to internet and mobile banking-enabled retai [+704 chars] [Bank of India] 4/21/25, 1:39 PM[ET Online][The Times of India] |

NBFC Finodaya Capital raises $2.5 million from White Venture Capital, others

Finodaya, which received its NBFC licence from the Reserve Bank of India on April 11, plans to offer micro loans against property to small businesses and micro enterprises across India and establish physical branches, cofounder Lokendra Tomar told ET.[Bank of India] 4/21/25, 6:00 AM[The Economic Times] |

Buy Bank of India, target price Rs 122: ICICI Direct

ICICI Direct recommends a buy for Bank of India, setting a target price of Rs 122.0 within 14 days. The bank's consolidated total income for the quarter ending December 31, 2024, reached Rs 20097.68 crore, reflecting a 21.65% increase compared to the same qua(What's moving Sensex and Nifty Track latest market news, stock tips, Budget 2025, Share Market on Budget 2025 and expert advice, on ETMarkets. Also, ETMarkets.com is now on Telegram. For fastest new [+330 chars] [Bank of India] 4/21/25, 3:41 AM[The Times of India] |

MTNL defaults on Rs 8,346 crore in bank loans; total indebtedness reaches Rs 33,568 crore

MTNL has defaulted on loan repayments exceeding Rs 8,300 crore to a consortium of banks, including Union Bank of India and State Bank of India, with default dates ranging from August 2024 to February 2025. The telecom operator's total financial indebtedness iMahanagar Telephone Nigam Limited (MTNL), the state-owned telecom operator, informed on Saturday that it has defaulted on loan repayments of over Rs 8,300 crore to multiple banks. In an exchange fili [+990 chars] [Bank of India] 4/20/25, 7:19 AM[ET Online][The Times of India] |

Bank holidays next week starting April 21: Banks to remain shut on THESE days; check schedule

The week starting April 21 comes with no local holidays or festive offs for the bankers, other than the RBI mandated weekly holidays. Check if Saturday, April 26 is workingAfter all public and private banks across India, including the State Bank of India (SBI), enjoyed a relaxed workweek starting April 14, the Indian banking sector is in for a busy week ahead.The wee [+2010 chars] [Bank of India] 4/20/25, 2:49 AM[Livemint][Livemint] |

Debt market snapshot: RBIs liquidity boost among other factors drive March movement

This intervention led to a softening in market rates. The 10-year government bond yield declined by 15 basis points (bps) to 6.58% in March from 6.73% in February.Indias debt market reflected improved sentiment in March, aided by strong liquidity support from the Reserve Bank of India (RBI), easing inflation, and a narrowing trade deficit. According to Puneet [+3402 chars] [Bank of India] 4/17/25, 2:45 AM[Nishtha Awasthi][The Times of India] |

ICICI Bank shares in focus as lender cuts savings account rates by 25 bps

Earlier this week, HDFC Bank also reduced its savings interest rate by 25 bps, bringing it to 2.75% for balances under Rs 50 lakh. This marks HDFCs first savings rate cut in five years. The State Bank of India (SBI) has already been offering 2.7% for balanceICICI Bank shares will be in focus on Thursday after the countrys second-largest private lender cut savings account interest rates by 25 basis points, following similar moves by HDFC Bank and Axis Ba [+2759 chars] [Bank of India] 4/17/25, 2:36 AM[ETMarkets.com][The Times of India] |

Amarnath pilgrims queue up for registration

Confusion and chaos prevailed outside a branch of the State Bank of India (SBI) in Patiala on Wednesday as residents were seen scrambling to submit their forms for the upcoming Amarnath Yatra, which is scheduled to begin on July 3. Some residents said they had been standing in the queue since 6 am, waiting for [...][Bank of India] 4/17/25, 2:12 AM[Tribune News Service][The Tribune India] |

Savings rates have dropped to 2.7%. Here's how to make your money work for you again

Most people think their money is safe in the bankbut with real returns turning negative thanks to inflation, its time to consider these six alternatives that balance safety, liquidity and performance.With HDFC Bank and Axis Bank slashing their savings account interest rates to just 2.75%, and State Bank of India (SBI) offering an even lower 2.7%, the money sitting "safely" in your account might a [+6550 chars] [Bank of India] 4/16/25, 12:27 PM[Neil Borate, Anil Poste][Livemint] |

Financial Intelligence Unit slaps Rs 37-lakh penalty on Union Bank of India

Financial Intelligence Unit-India (FIU-IND) in its order dated April 15 imposed a penalty of Rs 37 lakh for "discrepancies observed in a matter for the year 2011 to 2014 in reporting of suspicious transaction".The Financial Intelligence Unit (FIU) has slapped a Rs 37 lakh penalty on Union Bank of India for discrepancies in reporting suspicious transactions for 2011-2014. In a regulatory filing on Wednesday [+475 chars] [Bank of India] 4/16/25, 8:34 AM[PTI][The Times of India] |

PB Fintech shares in focus after RBI clears PB Pay as online payment aggregator

PB Fintech shares will be in focus after its subsidiary PB Pay received RBIs in-principle nod to operate as a payment aggregator. While this marks a key regulatory milestone, the stock trades above key short-term averages and shows bullish technical signals.Shares of PB Fintech, the parent company of Policybazaar, will be in focus on Wednesday after its wholly owned subsidiary, PB Pay, received in-principle approval from the Reserve Bank of India (RBI) [+1917 chars] [Bank of India] 4/16/25, 3:30 AM[ETMarkets.com][The Times of India] |

SBI cuts FD interest rates by 10 basis points for THESE two tenures starting today. Check details

With effect from April 15, State Bank of India (SBI) has cut its interest rates on fixed deposits (FDs) for two tenures: for 1 to 2 years and for 2 to 3 yearsWithin a week of Reserve Bank of India (RBI) cutting its repo rate by 25 basis points, the largest bank in India State Bank of India (SBI) has cut its interest rate on fixed deposits (FDs) by 10 basi [+1791 chars] [Bank of India] 4/15/25, 3:43 AM[Vimal Chander Joshi][Livemint] |

SBI shares in focus on reducing lending rate by 25 bps

State Bank of India has slashed its External Benchmark Based Lending Rate and Repo Linked Lending Rate by 25 basis points, following the RBIs repo rate cut to 6.25%. Effective April 15, the move is set to ease EMIs for retail borrowers and could buoy rate-seShares of State Bank of India (SBI) are likely to remain in focus during Tuesdays session after the lender announced a 25-basis-point reduction in its lending rates, in line with the Reserve Bank of [+1532 chars] [Bank of India] 4/15/25, 3:37 AM[Nishtha Awasthi][The Times of India] |

Bank of India cuts FD rates by up to 25 bps on these deposits; withdraws 400-day special FD offering 7.30% interest

Bank of India has revised its fixed deposit interest rates, effective April 15th, 2025. The bank has discontinued its special 400-day FD scheme, which offered a 7.30% interest rate. Interest rates have been reduced for short and medium-term deposits under RsBank of India (BOI), one of Indias prominent public sector lenders, has announced a series of revisions to its Fixed Deposit (FD) interest rates. The bank has withdrawn its special 400-day FD scheme. [+2211 chars] [Bank of India] 4/14/25, 7:53 AM[Sneha Kulkarni][The Times of India] |

Lower EMIs ahead? Bank of India cuts home loan interest rates to 7.90 per cent

The state lender has also cut interest rates across select existing retail loan products, including vehicle loan, personal loan, loan against property and education loanBank of India has announced to cut its home loan interest rates, offering relief to new as well as existing borrowers. With this change, the home loan rate stands reduced from 8.10 per cent per annum [+1780 chars] [Bank of India] 4/14/25, 7:49 AM[MintGenie Team][Livemint] |

Bank holiday today: Are banks closed on April 14 for Ambedkar Jayanti 2025? Check schedule here

Bank holiday today: Are banks closed on April 14 for Ambedkar Jayanti? Will banks also be closed on April 14? Check the April 2025 bank holidays schedule here.Bank holiday today, April 14 Ambedkar Jayanti 2025: Banks across various states in India, including the State Bank of India (SBI), are likely to be closed today, on April 14, on account of Ambedkar J [+3507 chars] [Bank of India] 4/14/25, 1:14 AM[Jocelyn Fernandes][Livemint] |

RBI will now allow banks and NBFCs to offload bad loans to investors directly

The Reserve Bank of India has introduced a new framework allowing banks and NBFCs to directly sell stressed assets to investors through special purpose entities, aiming to broaden the distressed debt market. This initiative introduces resolution managers to mThe Reserve Bank of India (RBI) has unveiled a new mechanism for banks and non-banking financial companies (NBFCs) to offload bad loans, allowing them to bundle and sell stressed assets directly to i [+1471 chars] [Bank of India] 4/12/25, 12:08 PM[ET Online][The Times of India] |

Banks scouting buyers for Sahara Star Hotel loans

Lenders led by Union Bank of India are set to auction the Rs 700 crore debt owed by Sahara Star Hotel after the insolvency plea was rejected. Banks are seeking all-cash bids after the offer from National Asset Reconstruction Company was deemed too low.Mumbai: Banks led by Union Bank of India are set to put the more than Rs 700 crore debt owed to them by the iconic Sahara Star Hotel on sale, after the National Company Law Appellate Tribunal rejecte [+2768 chars] [Bank of India] 4/12/25, 3:33 AM[Joel Rebello][The Times of India] |

Bank holiday today: Are banks open or closed on Saturday, April 12? Check here

Bank holiday today: Banks will be closed on April 12, 2025, as it is the second Saturday of the month. Generally banks are closed on second and fourth Saturday of the month as per RBI calendar.Bank holiday today: Banks will be closed on Saturday, April 12, 2025, according to the Reserve Bank of India (RBI) calendar.Why are banks closed on April 12?Banks are typically open on the first [+2095 chars] [Bank of India] 4/12/25, 1:00 AM[Riya R Alex][Livemint] |

What RBI's proposed norms mean for co-lending, gold loans

Two major frameworks proposed as part of the monetary policy statement on 9 April pertain to co-lending and lending against gold ornaments and jewelleryboth popular loan segments for lenders and borrowers alike.Mumbai: The Reserve Bank of India (RBI) has proposed changes to harmonize lending norms across regulated entities.Two major frameworks proposed as part of the monetary policy statement on 9 April p [+8302 chars] [Bank of India] 4/12/25, 12:30 AM[Anshika Kayastha][Livemint] |

More than a rate cut: RBIs decision reinforces its dual mandate

Amid global uncertainty thanks to unpredictable US tariffs, the Reserve Bank of Indias Monetary Policy Committee (MPC) unanimously effected a rate cut and shift in stance. This gives the Indian economy a confidence boost without compromising its inflation-chIn a move widely anticipated by analysts, the Reserve Bank of India (RBI) this week cut the policy repo rate by 25 basis points to 6% and shifted its monetary policy stance from neutral to accommodat [+5397 chars] [Bank of India] 4/11/25, 7:30 AM[mint][Livemint] |

No need to panic, over medium term, India to become a standout destination: Nilesh Shah, Envision Capital

Nilesh Shah of Envision Capital says it is not time to panic. Big bear markets were seen during COVID, during the global financial crisis or during 9/11. They lasted for six to nine months. India peaked out about six months ago. Maybe it is a question of anotNilesh Shah, MD & CEO, Envision Capital, says India is heading towards lower inflation which is going to encourage the Reserve Bank of India to keep cutting interest rates over a period of time a [+7243 chars] [Bank of India] 4/11/25, 2:41 AM[ET Now][The Times of India] |

RBI has done its bit: Fiscal and trade policy moves must do the rest

The central banks rate cut and deft management will help Indias economy absorb the US tariff blow, but we also need a government response: hike state spending, initiate trade reforms, pursue deregulation, expedite trade pacts and stay vigilant on dumping.It may just be a coincidence that the Reserve Bank of India (RBI) announced the rate-cut decision of its Monetary Policy Committee (MPC) on 9 April, the day that the US imposed reciprocal tariffs: i. [+5363 chars] [Bank of India] 4/10/25, 8:30 AM[mint][Livemint] |

RBI's Swaminthan J urges NBFCs to bolster risk controls, board oversight

Reserve Bank of India Deputy Governor Swaminathan J. has cautioned non-bank finance firms to enhance oversight of liquidity and credit risks, emphasizing the need for robust board-level controls to prevent vulnerabilities during market stress. He urged NBFCsIndian non-bank finance firms must step up oversight of liquidity and credit risks while strengthening board-level controls, a central bank deputy governor said, warning that weak governance could am [+1423 chars] [Bank of India] 4/10/25, 8:00 AM[Reuters][The Times of India] |

Bank of India, UCO Bank Cut Lending Rates After RBI Repo Rate Slash

This move is expected to make loans cheaper, encouraging more borrowing by individuals and businesses.[Bank of India] 4/10/25, 7:08 AM[Zee News][Zee News] |

RBI's policy stance turning accommodative shows signs of easing: SBI Report

The RBI has adopted a more accommodative policy stance as inflation expectations ease. A State Bank of India report says the shift is linked to changing household expectations, not just past data. With inflation forecast at 8.9% over the next three months, thThe Reserve Bank of India (RBI) has taken a more accommodative stance in its monetary policy, as inflation expectations have shown signs of easing. According to a recent report by the State Bank of I [+2387 chars] [Bank of India] 4/10/25, 3:04 AM[ANI][The Times of India] |

Higher US tariffs to impact local growth and inflation: RBI bos

RBI Governor Sanjay Malhotra warned of growth and inflation risks from global tariff wars and policy uncertainties, prompting a downward revision of India's FY26 growth forecast to 6.5%. He emphasized India's relative resilience due to lower export dependenceMumbai: Reserve Bank of India (RBI) governor Sanjay Malhotra on Wednesday highlighted risks to growth and inflation from the tariff war and policy uncertainties, with both businesses and households d [+2341 chars] [Bank of India] 4/10/25, 2:10 AM[ET Bureau][The Times of India] |

Trump's Tariffs Impact: RBI Governor Sanjay Malhotra's Warning On India's Growth

The global economic outlook has been clouded by President Trump's new tariffs, and Reserve Bank of India Governor Sanjay Malhotra has issued a stern warning about the implications for India's economy. In his first monetary policy statement of the financial year, Malhotra highlighted how these tariffs exacerbate uncertainties, dampen investments, and weigh down merchandise exports. He also warned of potential pressure on the rupee and imported inflation due to currency depreciation. The RBI has revised India's GDP growth forecast for FY26 to 6.5%, down from 6.7%, aligning with projections from global institutions like the IMF and OECD. Malhotra emphasized that while services exports remain resilient, merchandise exports face significant headwinds from trade disruptions. To mitigate these risks, the RBI has pivoted its stance to "accommodative," cutting the repo rate for the second consecutive month. Despite the challenges, Malhotra pointed out that India could benefit from trade diversions and a bilateral trade agreement with the U.S., expected later this year. As uncertainties loom large, watch this video to understand how Trump's tariffs are reshaping India's economic trajectory and the measures being taken to navigate this turbulent landscape.[Bank of India] 4/9/25, 4:14 PM[Business News India] |

RBIs monetary policy: navigating for growth in choppy waters

RBI has taken the mantle to support growth, which should limit the impact of global headwinds on Indias economy.The Reserve Bank of India had a challenging task in determining the course of interest rates and policy stance amidst extreme currency volatility, uncertainty in financial markets, and headwinds to g [+5075 chars] [Bank of India] 4/9/25, 1:44 PM[mint][Livemint] |

UCO Bank, Bank of India reduce lending rate after RBI's repo rate cut

Bank of India and UCO Bank said that the rate revision has been done following the RBI's reduction in the short-term lending rate (repo rate) earlier in the dayAfter RBI's decision to cut its repo rate on Wednesday, two state-run lenders - Bank of India and UCO Bank - announced 25 basis points reduction in lending rates.The move is likely to benefit exist [+527 chars] [Bank of India] 4/9/25, 1:25 PM[Livemint][Livemint] |

Bank of India, UCO Bank cut lending rate in line with RBI's policy

Bank of India and UCO Bank have reduced their lending rates by 25 basis points following the RBI's policy rate cut. Bank of India's new Repo Based Lending Rate (RBLR) is 8.85%, down from 9.10%, effective immediately. UCO Bank's rate is now 8.8%, effective ThuBank of India and UCO Bank have announced 25 basis points reduction lending rate within hours of RBI's decision to slash its policy rate on Wednesday, a move which will help existing and new borrower [+614 chars] [Bank of India] 4/9/25, 1:02 PM[PTI][The Times of India] |

New gold loan rules on cards: RBI proposes stricter norms, including monitoring use of funds

Banks' gold loans jumped 30% between September and February, sharply outpacing the growth in overall loans that was curtailed by tighter norms for unsecured lending. That surge in gold loans was despite the central bank's warning in September that it found seThe Reserve Bank of India on April 9 unveiled a new set of stricter regulations for financial institutions that give gold loans, which are basically loans secured by gold. The move RBI has proposed i [+2292 chars] [Bank of India] 4/9/25, 12:18 PM[ET Online][The Times of India] |

Looking at liquidity surplus of around 1% of deposits, RBI Governor Sanjay Malhotra says

The RBI aims to maintain banking system liquidity near 1% of total depositsaround 2 trillionto support policy rate transmission, Governor Sanjay Malhotra said. He stressed flexibility, adding the RBI would act as needed. Liquidity tools, including overnighThe Reserve Bank of India is expected to keep sufficient surplus in the banking system to ensure policy transmission and is looking at a level of around 1% of deposits, Governor Sanjay Malhotra said [+1895 chars] [Bank of India] 4/9/25, 8:42 AM[Reuters][The Times of India] |

As RBI cuts repo rate again, will your home loan EMI go down? | Explainer

With the RBI's 25 basis point repo rate cut, home loan EMIs are set to decrease. This follows a 50 basis point reduction over two months, impacting loans tied to MCLR and EBLR, although the extent of the benefit to consumers remains uncertain.As the Reserve Bank of India (RBI) on Wednesday cut the repo rate again by 25 basis points, home loan EMIs are expected to fall. In the past two months, RBI has cut the repo by a total of 50 basis po [+2252 chars] [Bank of India] 4/9/25, 8:40 AM[Vimal Chander Joshi][Livemint] |

RBI not done yet with rate cuts, Sanjay Malhotra hints at more

RBI Monetary Policy Repo Rate: RBI Governor Sanjay Malhotra hinted at a potential rate cut following two consecutive reductions, shifting the monetary stance to 'accommodative' to boost economic activity. The move aims to provide relief to borrowers with loweRBI MPC Meeting: After delivering two consecutive 25 basis point cuts in key policy rates, Reserve Bank of India (RBI) Governor Sanjay Malhotra on Wednesday suggested that another rate reduction may [+3401 chars] [Bank of India] 4/9/25, 8:28 AM[ET Online][The Times of India] |

WPI inflation likely eased to 2.1% in March on lower food, fuel prices: Union Bank Report

India's Wholesale Price Index (WPI) inflation is projected to decrease to 2.1% in March 2025, according to a Union Bank of India report. This moderation is primarily attributed to a seasonal drop in food prices, particularly vegetables. While edible oil and sNew Delhi: Wholesale Price Index (WPI) inflation is expected to ease to 2.1 per cent year-on-year in March 2025, down from 2.4 per cent in February, mainly due to a seasonal decline in food prices, a [+2071 chars] [Bank of India] 4/9/25, 7:17 AM[ANI][The Times of India] |

India central bank set to cut rates a second time as US tariffs add to risks

Reserve Bank of India is likely to reduce rates again. This is due to growth risks after United States import tariffs. Investors are watching the commentary closely. They want clues about future policy. Donald Trump imposed tariffs on India. This threatens InIndia's central bank is set to cut rates for a second time on Wednesday as risks to growth rise in the aftermath of U.S. import tariffs, with investors closely monitoring its commentary and a potenti [+2687 chars] [Bank of India] 4/9/25, 2:04 AM[Reuters][The Times of India] |

SBI Introduces Amrit Vrishti FD Scheme with 7.85% Returns After Shutting Amrit Kalash Scheme

The State Bank of India (SBI) has officially discontinued its highly popular Amrit Kalash Fixed Deposit (FD) scheme from April 1, 2025. The limited-period offer had gained a lot of traction for its attractive interest rates 7.10% per annum for regular depositors, and a lucrative 7.60% for senior citizens.[Bank of India] 4/6/25, 9:03 PM[Goodreturns] |

RBI to cut rates again? All eyes on central bank as it will commence FY26's first MPC meet

The RBI typically conducts six bimonthly meetings in a financial year, where it deliberates interest rates, money supply, inflation outlook, and various macroeconomic indicators. The other five meetings are scheduled for June 4-6, August 5-7, September 29-OctThe Reserve Bank of India's rate-setting panel is set to take its first monetary policy decision of the financial year in a review meetings starting Monday, amid a significant moderation in headline [+3057 chars] [Bank of India] 4/6/25, 8:25 AM[ET Online][The Times of India] |

Tata Capital Goes Ahead With Confidential IPO Plan, Targets Market Debut Worth Rs 15,000 Crore: Report

Tata Capital, the financial services subsidiary of Tata Sons, has taken a step toward going public by submitting a confidential pre-filing with the Securities and Exchange Board of India (SEBI), as per sources cited by Moneycontrol.The pre-filing mechanism, introduced by SEBI in late 2022, allows companies to initiate IPO proceedings without immediately disclosing business-sensitive data in the public domain.The proposed listing is expected to be among the largest from the Tata stable, with the issue size pegged at approximately Rs 15,000 crore. It will include both fresh issuance of shares and an offer for sale by existing stakeholders, including Tata Sons and the International Finance Corporation (IFC), both likely to lead the dilution exercise.IPO Structure and Advisor Roster FinalisedAccording to the report, Tata Capitals board had already greenlit the IPO on February 25, which includes the issuance of up to 230 million new equity shares. The launch of the IPO will be contingent on prevailing market conditions and regulatory clearances.In preparation for the listing, Tata Capital has onboarded ten investment banks to manage the offer. The advisory group comprises Kotak Mahindra Capital, Axis Capital, Citi, JP Morgan, ICICI Securities, HSBC Securities, BNP Paribas, SBI Capital, HDFC Bank, and IIFL Capital.A Fitch Ratings update noted that despite the dilution, Tata Sons is expected to retain a minimum 75 per cent stake in the company post-IPO. As of March 31, 2024, Tata Sons held a 92.83 per cent stake, with the balance split between other Tata Group companies and IFC.Also Read : Tata Steel Challenges Tax Reassessment Order Of Over Rs 25,000 Crore In Bombay HCStrong Financial Footing and Business ExpansionTata Capital operates as a systemically important, non-deposit-taking Core Investment Company registered with the Reserve Bank of India (RBI). It caters to both wholesale and retail finance markets and has steadily expanded its lending portfolio.Its assets under management reached Rs 158,479 crore by the end of FY24, marking a notable increase from Rs 119,950 crore in FY23 and Rs 94,349 crore in FY22, according to Crisil Ratings.In addition, Tata Sons has continued to support its financial arm through significant capital infusions, injecting Rs 6,097 crore over the last five financial years. This includes Rs 2,500 crore in FY19, Rs 1,000 crore in FY20, Rs 594 crore in FY23, and Rs 2,003 crore in FY24.In a separate move to strengthen its capital base, Tata Capital also cleared a Rs 1,504 crore rights issue earlier this year, with Tata Sons expected to fully subscribe.Joining a Growing List of Pre-Filing ParticipantsWith this filing, Tata Capital joins a cohort of prominent Indian firms that have opted for the confidential IPO route. Others in the list include Tata Play, Oyo, Swiggy, Vishal Mega Mart, Credila Financial Services, Indira IVF, and PhysicsWallah.The pre-filing mechanism permits companies to file the draft red herring prospectus (DRHP) with SEBI discreetly, enabling them to make internal evaluations based on the regulators observations before making any public announcement. If they proceed with the IPO, the DRHP must be made public 21 days before the red herring prospectus is filed. If not, the process can be quietly shelved without market repercussions.[Bank of India] 4/5/25, 4:09 PM[ABP Live Business][Abp News] |

SBI PO Result 2025 out on sbi.co.in: Check your prelims results and mains eligibility now

The State Bank of India has announced the SBI PO Prelims Result 2025 for candidates who took the exam in March 2025. Those who pass will proceed to the Mains exam, followed by an Interview and a Psychometric Test. There are 600 Probationary Officer vacanciesThe State Bank of India (SBI) has released the SBI PO Prelims Result 2025 on 5 April 2025. Candidates who took the exam on 8, 16, and 24 March 2025 can now check their results online. To see their sc [+2257 chars] [Bank of India] 4/5/25, 1:00 PM[ET Online][The Times of India] |

Kerala launches digital payment system, online services in govt hospitals

Kerala Health Minister Veena George announced the introduction of digital payment systems in 313 government hospitals to facilitate various service fee transactions. This system, part of the e-health initiative, employs POS devices from State Bank of India anKerala Health Minister Veena George on Saturday announced that digital payment systems have been introduced in government hospitals across the state to facilitate fee payments for various services. I [+2152 chars] [Bank of India] 4/5/25, 12:13 PM[PTI][The Times of India] |

Bank holiday today: Are banks open or closed on Saturday, April 5? Check here

Bank holiday today: Banks will be open on April 5, 2024, as it is the first Saturday of the month, according to the RBI. However, banks will be closed in Telangana for Babu Jagjivan Ram's Birthday. Online banking services will remain accessible during bank hoBank holiday today: Banks will remain open on Saturday, April 5, 2024, according to the Reserve Bank of India (RBI) calendar. Typically, banks are open on the first and third Saturdays of every month [+2002 chars] [Bank of India] 4/5/25, 2:52 AM[Riya R Alex][Livemint] |

Union Bank of India reports 8.6 pc loan growth in Q4

Union Bank of India reported an 8.6 per cent credit growth to Rs 9.82 lakh crore in the March 2025 quarter. Total business rose 7.8 per cent to Rs 22.92 lakh crore. Similarly, J&K Bank and Ujjivan Small Finance Bank posted significant increases in advances anState-owned Union Bank of India on Friday said it has posted a credit growth of 8.6 per cent to Rs 9.82 lakh crore during March 2025 quarter. Total advances were Rs 9.04 lakh crore at the end of Marc [+982 chars] [Bank of India] 4/4/25, 1:42 PM[PTI][The Times of India] |

US tariffs to hit India's GDP growth, prompt more rate cuts

India's economic growth is expected to slow by 20-40 basis points this financial year, driven by new U.S. tariffs. Analysts predict deeper interest rate cuts by the Reserve Bank of India to counterbalance the impact, with GDP growth estimates revised down toIndia's economic growth could slow by 20-40 basis points in the ongoing financial year due to the latest U.S. tariffs, which would prompt deeper interest rate cuts by the central bank, analysts said. [+2912 chars] [Bank of India] 4/4/25, 7:32 AM[Reuters][The Times of India] |

BlackSoil-Caspian Debt merger secures RBI nod, awaits NCLT approval

BlackSoil Capital and Caspian Debt, approved by the RBI for merger, await NCLT clearance. The merger boosts BlackSoils lending capacity to MSMEs and startups, expanding its presence in major metros. The combined entity will manage assets over Rs 2,000 crore,BlackSoil Capital, an alternative credit platform, and Caspian Debt, an impact investment lender, have received approval from the Reserve Bank of India (RBI) for their merger. The deal now awaits cle [+1609 chars] [Bank of India] 4/3/25, 8:34 AM[The Times of India] |

RBI approves 100% stake acquisition of Shriram Overseas Investments from Shriram Investments Holdings

The Reserve Bank of India approved the complete acquisition of Shriram Overseas Investments by Shriram Investments Holdings. Shriram Finance, part of the Shriram Group, aims to achieve asset levels of Rs 3 lakh crore this fiscal year with projected 15% loan gThe Reserve Bank of India on Tuesday approved 100 per cent acquisition of Shriram Overseas Investments from Shriram Investments Holdings.The company also said that the central bank has approved the a [+1200 chars] [Bank of India] 4/1/25, 1:22 PM[ET Online][The Times of India] |

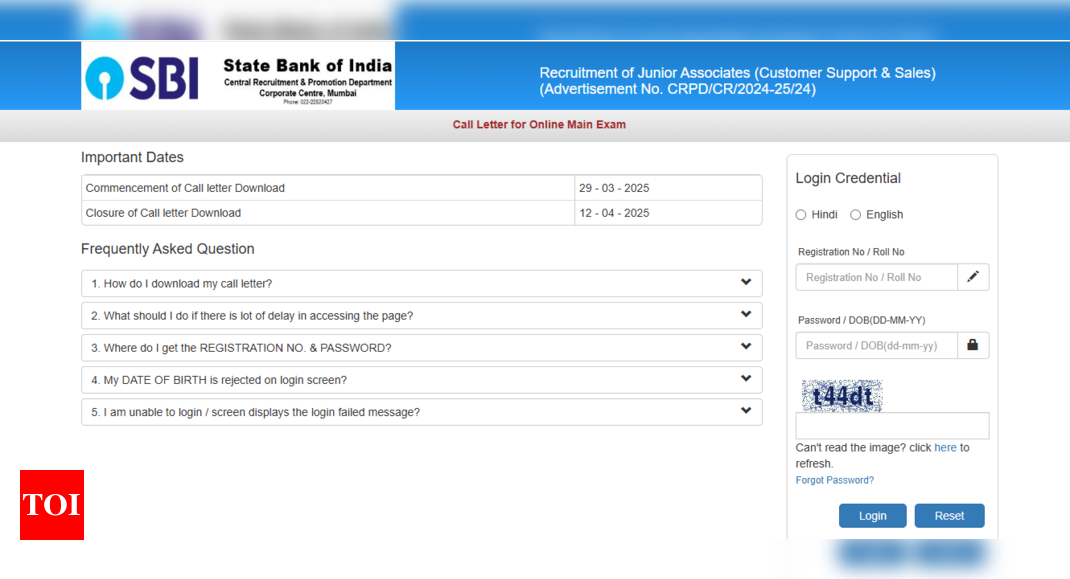

SBI Clerk Mains admit card 2025 out now: Direct link to download and key exam guidelines

State Bank of India has issued admit cards for the Junior Associates Mains Exam 2025, scheduled on April 10 and April 12. Candidates must download the hall tickets from SBI's official website and carry necessary documents, including a valid photo ID proof, toOffer Exclusively For YouSave up to Rs. 700/-ON ET PRIME MEMBERSHIPAvail OfferOffer Exclusively For YouGet 1 Year FreeWith 1 and 2-Year ET prime membershipAvail OfferOffer Exclusively [+246 chars] [Bank of India] 4/1/25, 12:33 PM[ET Online][The Times of India] |

Salila Pande takes charge as MD and CEO of SBI Card

Salila Pande has been appointed MD & CEO of SBI Card, effective April 1. With nearly three decades at SBI and key leadership roles in India and abroad, Pande is expected to drive innovation and growth for SBI Card. She previously led the retail business at SBSBI Card has appointed Salila Pande as its managing director and chief executive officer with effect from April 1.Pande has worked for almost three decades at the State Bank of India (SBI) and held s [+1394 chars] [Bank of India] 4/1/25, 8:37 AM[Prachi Verma][The Times of India] |

SBI online banking services, UPI down till this time today: Know when they will be back, what to use in mean time

SBI UPI payments: State Bank of India's (SBI) key banking services will be temporarily unavailable on April 1, 2025. State Bank of India (SBI) Customers can still use some services during this time. Customers should plan transactions accordingly to avoid incoThe State Bank of India (SBI) has informed its customers that certain banking services will be temporarily unavailable today on April 1, 2025, for a specific duration due to the bank's Annual Closing [+2863 chars] [Bank of India] 4/1/25, 8:03 AM[Sneha Kulkarni][The Times of India] |

SBI Clerk Mains admit card 2025 released: Direct link to download hall tickets here

The State Bank of India (SBI) has released the admit card for the Junior Associates Mains Exam 2025 on April 1. Candidates can download the hall ticket by entering their Registration Number and Password. The Mains Exam will be held on April 10 and 12. CandidaTamannaah Bhatia Radiates Elegance in Mesmerising Outfits [Bank of India] 4/1/25, 7:58 AM[TOI Education][The Times of India] |

SBI Clerk Mains Admit Card 2025 released at sbi.co.in: Check how to download your hall ticket now

SBI Clerk Mains Admit Card 2025: The State Bank of India will release the SBI Clerk Mains Admit Card 2025 in the next two days. Candidates can download their hall tickets from the official website, sbi.co.in. The mains exam is scheduled for April 10 and AprilOffer Exclusively For YouSave up to Rs. 700/-ON ET PRIME MEMBERSHIPAvail OfferOffer Exclusively For YouGet 1 Year FreeWith 1 and 2-Year ET prime membershipAvail OfferOffer Exclusively [+246 chars] [Bank of India] 4/1/25, 7:42 AM[ET Online][The Times of India] |

RBI@90! Earning peoples trust is RBIs biggest achievement in nine decades, President Droupadi Murmu says

President Droupadi Murmu highlighted the Reserve Bank of India's trust earned over nine decades, emphasizing its commitment to price stability, growth, and financial stability. She noted the RBI's proactive measures against financial fraud and its role in fostering financial inclusion and digital payments.[Bank of India] 4/1/25, 7:12 AM[The Economic Times] |

Financial markets' shift in US exceptionalism perspective triggers U-turn in US dollar: UBI

The financial markets are questioning the belief in US exceptionalism due to tariff threats and uncertainties, shifting their view towards vulnerabilities similar to other economies. This has led to a downward trend in the USD. The global economy grew by 3.3%Amid the ongoing tariff threat environment, the financial markets have begun shifting their perspective on the US economy, which has impacted the USD.According to a report by the Union Bank of India, [+2633 chars] [Bank of India] 4/1/25, 3:22 AM[ANI][The Times of India] |

Sebi exempts govt from making open offer to Vodafone Ideas shareholders post-dues conversion

Sebi exempts govt from making open offer to Vodafone Idea's shareholders post-dues conversionNew Delhi, Apr 3 (PTI) Markets regulator Sebi on Thursday exempted the government from making an open offer to the shareholders of Vodafone Idea Ltd (VIL) following its proposed acquisition of just o [+2736 chars] [Vodafone Idea Ltd] 4/3/25, 1:14 PM[list.metadata.agency][Livemint] |

Why govts Vodafone Idea stake will hasten telecom tariff hikes

Vodafone Idea hit the upper circuit breaker today after the government converted 36,950 crore in overdue spectrum charges into equity, acquiring a 49% stake in the telecom operator amid its financial struggles. This could have implications for not just Vi bOn Saturday, the government converted 36,950 crore overdue spectrum charges from Vodafone Idea Ltd into equity, becoming the biggest shareholder in Indias third-largest telecom operator with a 49% st [+4420 chars] [Vodafone Idea Ltd] 4/1/25, 1:01 PM[T. Surendar][Livemint] |

RBL Bank Q4 Results: Consolidated profit slumps 76% to Rs 87 crore as unsecured loans bite

State-owned Bank of Maharashtra (BoM) on Friday reported a 23 per cent rise in net profit to Rs 1,493 crore in the March 2025 quarter on the back of core income and reduction in bad loans.State-owned Bank of Maharashtra (BoM) on Friday reported a 23 per cent rise in net profit to Rs 1,493 crore in the March 2025 quarter on the back of core income and reduction in bad loans. The Pune-h [+2087 chars] [Bank of Maharashtra] 4/25/25, 1:17 PM[PTI][The Times of India] |

Stock market update: Nifty Pharma index advances 1.98%

The Nifty Pharma index closed 1.98 per cent up at 21908.1.NEW DELHI: The Nifty Pharma index closed on a positive note on Monday. Shares of Lupin Ltd.(up 4.25 per cent), Ajanta Pharma Ltd.(up 3.71 per cent), Glenmark Pharmaceuticals Ltd.(up 3.45 per cent), Z [+1097 chars] [Lupin Ltd] 4/28/25, 11:57 AM[ETMarkets.com][The Times of India] |

Poonawalla Fincorp enters gold loan market, plans 400 new branches

Poonawalla Fincorp Ltd. has entered the gold loan market, aiming to broaden its secured lending options. This new product offers quick, transparent financing for various needs, with approvals promised in under 30 minutes. The company plans to open 400 branchePoonawalla Fincorp Ltd (PFL), a non-banking financial company (NBFC) promoted by the Cyrus Poonawalla Group, has entered the gold loan segment, expanding its secured lending portfolio. The company an [+1428 chars] [Poonawalla Fincorp Ltd] 4/15/25, 3:28 AM[ET Online][The Times of India] |

Paytm shares in focus as subsidiary faces Rs 5,712 crore GST demand notice

Paytm share price: Paytms subsidiary, First Games Technology, has received a Rs 5,712 crore Show Cause Notice from the GST authorities, demanding 28% GST on total entry amounts for January 2018March 2023. Paytm clarified that the notice will have minimal fiShares of One 97 Communications Ltd (Paytm) are likely to be in focus on Tuesday, April 29, after its subsidiary, First Games Technology, received a Show Cause Notice (SCN) from the Directorate Gener [+2147 chars] [One 97 Communications Ltd] 4/29/25, 3:42 AM[ETMarkets.com][The Times of India] |

Buy Astral, target price Rs 1,475: Axis Securities

Axis Securities recommends a 'Buy' for Astral shares, setting a target price of 1,475, indicating a 10% upside from the current market price of 1,314.95. Astral reported a consolidated total income of 1,408.80 crore for the quarter ending December 31, 2024Axis Securities has a buy call on Astral with a target price of Rs 1,475. The current market price of Astral Ltd. is Rs 1314.95. Astral, incorporated in 1996, is a Mid Cap company with a market cap o [+1470 chars] [Astral Ltd] 4/9/25, 3:41 AM[ETMarkets.com][The Times of India] |

Max Healthcare Institute to invest Rs 6,000 cr to add 3,700 beds by 2028

Max Healthcare will invest Rs 6,000 crore by 2028 to add 3,700 beds across India, increasing its facilities to around 30 hospitals. The expansion, funded internally, includes the recent inauguration of a 300-bed hospital in Dwarka, Delhi, and upcoming facilitMax Healthcare Institute Ltd will invest Rs 6,000 crore by 2028 to add 3,700 beds across key locations in India, its Chairman and Managing Director Abhay Soi said on Tuesday. Max Healthcare, which op [+2170 chars] [Max Healthcare Institute Ltd] 4/29/25, 8:09 AM[PTI][The Times of India] |

SJVN releases Rs 269.97 cr land compensation for 3,097 MW Etalin hydro project in Arunachal

The land compensation amount was deposited in the joint account of DC & DLRSO, Dibang Valley on March 26, 2025, Raj Kumar Chaudhary, Chairman & Managing Director (Additional Charge) of SJVN, informed during a review meeting chaired by Arunachal Pradesh ChiefState-owned SJVN Ltd on Thursday said it has released land compensation of Rs 269.97 crore for 3,097 MW Etalin Hydro Power Project in Dibang Valley, Arunachal Pradesh. The project aims to construct t [+1588 chars] [SJVN Ltd] 4/10/25, 1:23 PM[PTI][The Times of India] |

Ambuja Cements, Adani Green & more: Top stocks on brokers' radar for May 2 - Times of India

Ambuja Cements, Adani Green & more: Top stocks on brokers' radar for May 2 Times of IndiaFirst Tick: Here are the top global cues for todays trade MoneycontrolStocks to watch on May 2: Auto stocks, Federal Bank, JSW Infra, NCC, Zomato and more CNBC TV18Stock market today: Trade setup for Nifty 50 to India-Pakistan tension; Eight stocks to buy or sell on Friday MintStocks to Watch, May 2: Marico, Indian Overseas Bank, Adani Enterprises, Adani Ports, Eternal, TVS Motor, Maruti, Tata Motors, and more Upstox[Indian Overseas Bank] 5/2/25, 7:10 AM[Google News] |

Buy or sell: Vaishali Parekh recommends three stocks to buy today 2 May 2025 - Mint

Buy or sell: Vaishali Parekh recommends three stocks to buy today 2 May 2025 MintStocks to Watch, May 2: Marico, Indian Overseas Bank, Adani Enterprises, Adani Ports, Eternal, TVS Motor, Maruti, Tata Motors, and more UpstoxBreakout stocks to buy or sell: Sumeet Bagadia recommends five shares to buy today 2 May 2025 MintStocks in news: Eternal, Marico, Adani Enterprises, HAL, Bandhan Bank The Economic TimesStocks to Watch Today: PNB Housing, JSW Energy, Maruti Suzuki, M&M, Paras Defence, Federal Bank,... Moneycontrol[Indian Overseas Bank] 5/2/25, 7:09 AM[Google News] |

RBI imposes monetary penalties on Indian Bank, Indian Overseas Bank

RBI also imposed a monetary penalty on Mahindra & Mahindra Financial Services[Indian Bank, Indian Overseas Bank] 4/25/25, 9:11 PM[The Hindu - Business Line] |

UNO Minda, JV boards approve project report for EV power train products

UNO Minda Ltd and Suzhou lnovance Automotive have approved a Rs 423 crore project to develop and manufacture high-voltage EV power train products through their joint venture. UNO Minda's board has also approved a Rs 114 crore investment for a 70% stake in theAuto components maker UNO Minda Ltd on Wednesday said a detailed project report to develop and manufacture high voltage electric vehicle power train products through its joint venture with Suzhou lno [+2212 chars] [UNO Minda Ltd] 4/30/25, 8:34 AM[PTI][The Times of India] |

Oberoi Realty FY25 sales bookings rise 31% to Rs 5,266 cr

Oberoi Realty Ltd witnessed a significant surge in sales bookings, reporting a 31% annual increase to Rs 5,266 crore in the last fiscal year, driven by robust housing demand. The company sold 928 units, marking a substantial rise from the previous year's 705Real estate firm Oberoi Realty Ltd on Saturday reported a 31 per cent annual increase in sales bookings to Rs 5,266 crore during the last financial year on strong housing demand. The Mumbai-based com [+535 chars] [Oberoi Realty Ltd] 4/19/25, 12:14 PM[PTI][The Times of India] |

Vedanta group firm HZL plans to foray into potash mining; eyeing block in Rajasthan

Hindustan Zinc Ltd (HZL) is diversifying into potash mining, targeting a Rajasthan block with potential lithium reserves, aiming to reduce India's import dependence. The company plans to expand beyond zinc, lead, and silver into critical minerals, securing goVedanta group firm Hindustan Zinc Ltd (HZL) plans to foray into potash mining and is eyeing a block in Rajasthan which has a fair chance of having lithium reserves also, a top official of the company [+2104 chars] [Hindustan Zinc Ltd] 4/27/25, 8:41 AM[PTI][The Times of India] |

Latest News | CCI Clears Bharat Forge-AAM India Manufacturing Deal with Voluntary Modifications

Get latest articles and stories on Latest News at LatestLY. The Competition Commission of India (CCI) on Tuesday approved Bharat Forge Ltd's acquisition of AAM India Manufacturing Corporation Pvt Ltd after accepting certain voluntary modifications proposed by the companies.[Bharat Forge Ltd] 4/22/25, 9:14 PM[Latestly] |

Canara, Indian Bank trim home, vehicle loan rates

Canara and Indian Bank have reduced their repo-linked lending rates (RLLR) by 25 basis points, aligning with the RBI's efforts to make home and vehicle loans more affordable. Indian Bank has decreased its home loan interest rates to 7.90% and vehicle loan rates to 8.25%. Canara Bank also announced a reduction, with housing loans now starting at 7.90%.[Indian Bank] 4/25/25, 7:14 AM[The Times Of India] |

Indian Bank eyes to disburse Rs 20,000 crore to SHGs in this financial year

Indian Bank aims to disburse Rs 20,000 crore to Self Help Groups nationwide this financial year, demonstrated by a 'Mega SHG Credit Outreach Programme' in Bhubaneswar. The initiative supports the national mission of empowering one crore SHG women with creditPublic sector Indian Bank has set a target to disburse Rs 20,000 crore to Self Help Groups nationwide during the current financial year, an official said. The city-headquartered bank conducted a 'Meg [+894 chars] [Indian Bank] 4/20/25, 11:49 AM[PTI][The Times of India] |

Trade Spotlight: How should you trade Indian Bank, Zee Entertainment, Ceat, Aditya Birla Capital, Max Financial, Engineers India, and others on April 17?

[Indian Bank] 4/17/25, 1:43 AM[Moneycontrol][Moneycontrol] |

NCLAT allows banks to proceed against former IL&FS directors not part of new board

The NCLAT has permitted Canara Bank and Indian Bank to pursue actions against former IL&FS directors, excluding those on the new board, to declare them wilful defaulters. This protection extends to reappointed professional directors. The decision comes afterThe National Company Law Appellate Tribunal (NCLAT) has allowed state-owned Canara Bank and Indian Bank to pursue proceedings against former IL&FS directors, who are not part of the new board, to [+3033 chars] [Indian Bank] 4/8/25, 8:40 AM[PTI][The Times of India] |

South Indian Bank reports 10% advances growth, 5.5% deposit growth

South Indian Bank experienced a 10% increase in gross advances, reaching Rs 88,447 crore by the end of FY25, while deposits grew at a slower rate of 5.5%, totaling Rs 1.08 lakh crore. The bank's CASA share slightly decreased compared to the previous year butSouth Indian Bank on Wednesday reported a 10% growth in gross advances while its deposits grew at a slower 5.5% pace.The bank's gross advances stood at Rs 88447 crore at the end of FY25 while total d [+681 chars] [Indian Bank] 4/2/25, 1:36 PM[Atmadip Ray][The Times of India] |